By Morgan E. Mahaffey, JD and Joseph A Wallace, CPA

The reduction in corporates rates coupled with a broadening of the tax base is a major shift in tax policy. While it may take several months to sort through the implications of the mid-term elections and policy changes from Congress, there is no doubt this piece of legislation will have a significant impact on 2018 tax planning and beyond.

For the affordable housing industry, one of the more important changes brought about by the TCJA is the limitation on the amount of business interest that can be deducted by a taxpayer. Starting in 2018, businesses are only able to deduct business interest expense up to 30% of their taxable income. Fortunately, until 2022 there is a depreciation add back included in the calculation of the business interest limitation.

In many instances affordable housing projects are loss-generating ventures, even with the addback, these projects are not going to be able to claim the full amount of their business interest expense unless they make the irrevocable election to be treated as a real property trade or business for the purpose of the business interest limitation.

Granted it seems like an easy decision: make the election, claim the interest, and life goes on as normal. But, in the words of Lee Corso, “Not so fast my friend!” The election has a string attached.

If a project makes the election to be treated as a real property trade or business, then the building must be depreciated using the Alternate Depreciation System( ADS) rather than the Modified Accelerated Cost Recovery System (MACRs). ADS generally recovers costs over a longer time-period than MACRS (40 years as opposed 27.5 years). To mitigate some of the pain of the election, a new 30 year ADS class life was included in the TCJA for residential buildings placed in service after December 31, 2017. As a result, on a go forward basis the issue is less significant than it is for assets placed in service before 2018.

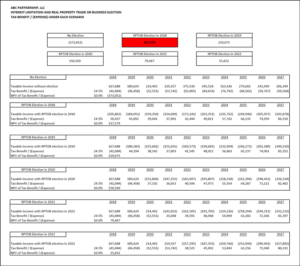

For the projects that qualify for the 30 year class life, the decision to elect to be treated as a real property trade or business is fairly easy. It is difficult to think of a set of circumstances where it does not make more sense to make the election to deduct the entire amount of interest expense than to claim depreciation over 27.5 years rather than 30 years. The math gets more complicated when the choice is between 40 year ADS as opposed to 27.5 year MACRS. In the models we have run, it is common for the MACRS depreciation to be more valuable than the business interest deduction. Yet, this is only temporary since the depreciation addback goes away in 2022.

Another factor contributing to complexity of the analysis is the fact that the older deals were underwritten based on both 27.5 MACRS depreciation and no business interest limitation. Syndicators are likely to look for solutions, like cost segregation studies, to make sure projects hit the IRR’s that were promised to investors. General Partners who plan to operate the project after the 15 year compliance period will want to take a close look at the opportunity cost associated with electing to perform a cost segregation study while the investor is in the partnership.

Finally, under the limitation, the excess interest expense is not lost forever, rather it is carried forward to the next year and applied against any excess business income. As a result, the time value of money enters into the decision. Some projects will have excess business income sooner than others based on their debt structures, operations, etc. When they do, the suspended interest may be deducted. Additionally, when a partner sells its interest in a partnership and has excess business interest that has been allocated to the partner, the partner’s capital account is increased immediately before the transfer by the excess business interest. Thus, there is a long-term tax benefit that must be discounted and factored into the decision of whether to make the election.

The takeaway of all this is there is not a one size fits all rule of thumb that can be used in making the decision to elect to be a real property trade or business and opt out of the business interest deduction limitation. Projects are going to have to do a forecast and calculate the net present value of the business interest limitation compared to the depreciation expense. Depending on the size of the project and the amount of interest being incurred, the wrong decision will have a real impact on the projects bottom line.

From a decision modeling perspective, two questions must be answered. The first is whether the business interest deduction is more valuable to the Partnership than the accelerated cost recovery under MACRs (27.5 years straight line for residential real property)? Second, does the project qualify for the additional bonus depreciation?

Regarding the business interest deduction limitation, there are basically three scenarios that need to be considered:

- For partnership assets placed in service prior to September 28, 2017, should the Partnership(s) elect out of the business interest deduction limitation for 2018. If so, what is the impact of recasting the depreciation over a 40 year recovery period?

- For partnership assets placed in service after December 31, 2017, should the Partnership(s) elect out of the business interest deduction limitation. If so, what is the impact of recasting the depreciation over 30 year recovery period?

- For partnership assets placed in service after December 31, 2017, what is the impact of not electing out of the business interest deduction limitation?

Regarding bonus depreciation, the analysis is primarily a determination of whether a binding contract existed prior to September 28, 2017. Additionally, both the business interest deduction limitation and the additional bonus depreciation require an analysis of their impact to the capital account maintenance.

To discuss your affordable housing project needs, please contact Morgan E. Mahaffey, JD or Joseph A. Wallace, CPA

Meet the Authors

Joseph A Wallace

Joseph A Wallace

Tax Partner

704.491.9940

Morgan E. Mahaffey, JD

Morgan E. Mahaffey, JD

Senior Tax Manager

614.214.3323