By: Amie Gray When considering the Qualified Contract process, price calculation can help determine whether or not to seek early release from IRC Section 42 compliance. (more…)

LIHTC

The Inflation Reduction Act (IRA) of 2022 provided taxpayers with a tax credit for new or largely reconstructed homes that meet the DOE Zero Energy Ready Home (ZERH) requirements by amending Internal Revenue Code Section 45L. This legislation included a ten-year extension of the 45L Energy Efficiency Home Credit and nearly $370 billion in provisions for green energy efforts. According…

By Missouri State Senator Denny Hoskins, CPA Across America, cities are facing an enormous affordable housing deficit. In many states, bills are being considered that will impact future efforts to fund and build low-income housing. Here is how you can have a say in these important housing decisions when they are considered. (more…)

RAD for PRAC Offers Solutions for Aging Section 202 Properties By Andrew Gantzer, CPA, and Justin Heberling, CPA, HCCP A recent HUD evaluation of the federal Rental Assistance Demonstration (RAD) shows that the program is achieving its goal of preserving public housing and improving the conditions of distressed public housing. Since enacted through Congress in 2012, the program has stimulated billions…

By Lee Dodson, CPA, and Jeremy Densmore, CPA, HCCP Timely delivery of first-year credits benefits developers, syndicators and investors in a Low Income Housing Tax Credit (LIHTC) development. The project itself also benefits because additional equity may be contributed, which means additional funds are available to get the project off to a good start. In this article, we will cover…

By Ashley Northcutt and Chris Thomas New IRS rules on the 100% bonus deprecation deduction may expand the benefits of cost segregation studies. This month, the IRS issued two sets of regulations under IRS Section 168(k) – final and proposed – that clarify qualifying property. The final regulations explain the “increase of the benefit and expansion of the universe of…

By Damien Cassell, CPA and Morgan E. Mahaffey, JD The U.S. Department of Housing and Urban Development (HUD) continues to make it easier for developers and owners to use loan programs for LIHTC and Opportunity Zone projects. With announcements this year that promise easier facilitation and closing of FHA loans as well as incentives to develop projects in opportunity zone…

By: Kevin E. Allmandinger, CPA and Bart W. Parry, CPA With heightened accountability and state agencies increasing oversight in an effort to mitigate fraud risk, General Contractor Cost Certifications (GCCCs) for low-income housing projects are becoming increasingly important. General contractors must contend with inaccurate or incomplete accounting records, unpleasant and avoidable fire drills, and extra costs if they do not…

By: Joel T. McDowell, CPA, Quinn Gormley and Morgan E. Mahaffey, JD Many states have enacted tax incentives similar to the Federal General Business Credits[1]or the Low Income Housing Tax Credit. Specifics differ between states, but generally these “State Tax Credits” can be classified either as transferable or allocated tax credits. Transferable credits bifurcate the benefits of the credit from the actual ownership…

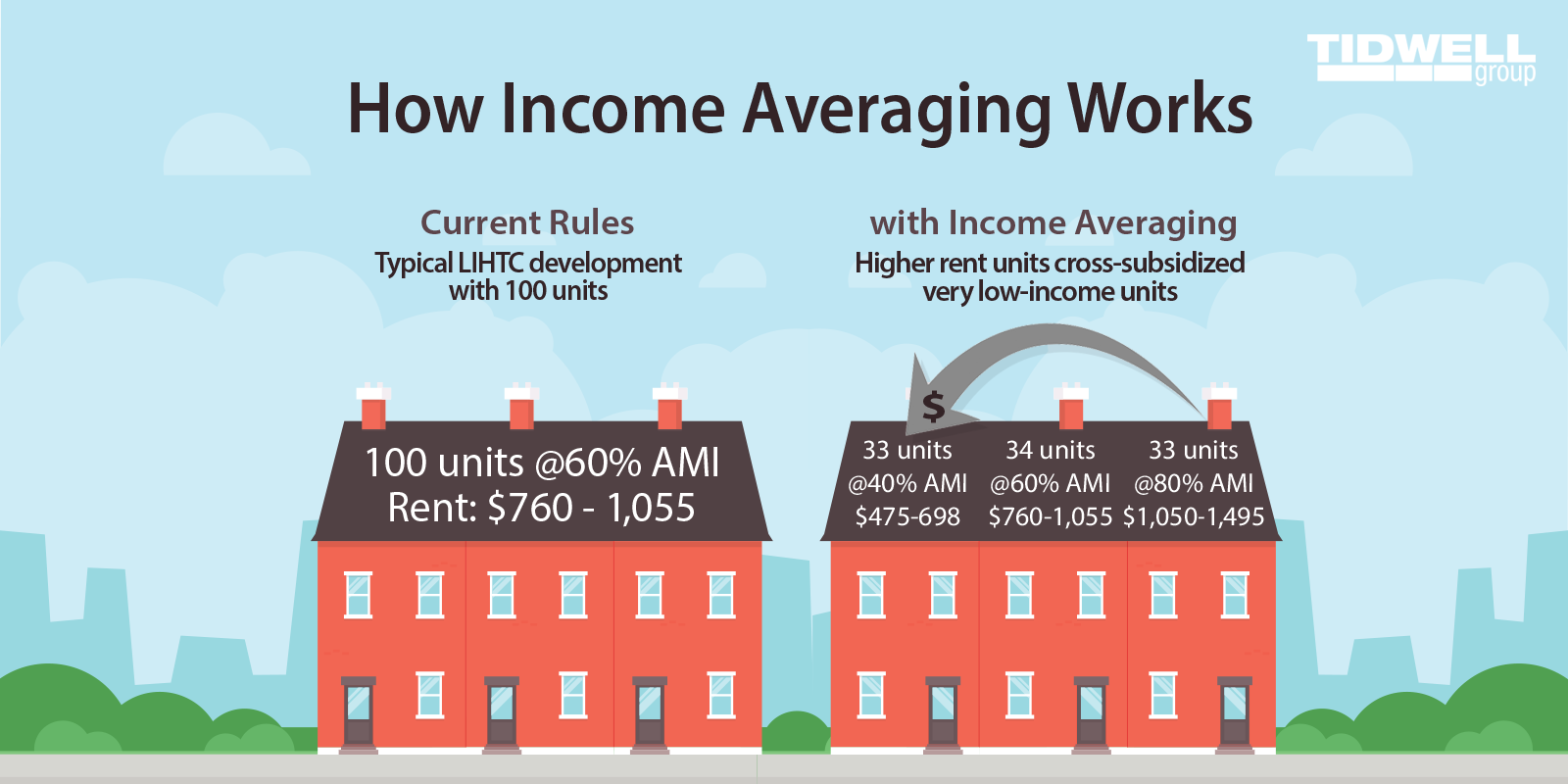

By: Jeremy Densmore While a number of state agencies are starting to adopt Income Averaging (IA)[1] policies, there is still speculation on what the future IRS guidance will be. Recent industry articles have provided some speculative insight outlining common approaches for interpreting the IA amendment to the code. However, in the midst of all the opportunities that IA provides, the…

Not-for-profit entities (NFPs) should be aware that ASU 2016-14 is required to be implemented for the year ended December 31, 2018, and the changes in this standard will have a significant impact on the presentation of NFP entity financial statements. While Tidwell Group provided an introductory article containing timely guidance regarding ASU 2016-14, Chris Bailey and Patty Azallion, Tidwell Group…

By: Quinn Gormley On October 22nd HUD announced via Federal Register Vol. 83 No. 204, designated Qualified Census Tracts (QCTs) and Difficult to Develop Areas (DDAs) for 2019. The QCT and DDA is an important means for many of these areas in the production of affordable housing under the Housing Tax Credit Program (IRC §42), especially for developments that plan to…

By Morgan E. Mahaffey, JD and Joseph A Wallace, CPA The reduction in corporates rates coupled with a broadening of the tax base is a major shift in tax policy. While it may take several months to sort through the implications of the mid-term elections and policy changes from Congress, there is no doubt this piece of legislation will have a significant…

Tidwell Group has issued a follow-up to this article and can be found by clicking this link. “Income averaging (IA)” is the new kid on the Low Income Housing Tax Credit (LIHTC) block. However, while the new IA rules appear simple, they simply are not. The Consolidation Appropriations Act of 2018 ushered IA into the affordable housing (AH) arena with…

When it comes to job satisfaction, the importance of finding a healthy balance between the rigors of full-time employment and the increasingly hectic personal schedules of career professionals . . . particularly those of professional women, cannot be overstated! In fact, a recent study showed that when companies do what it takes to help facilitate that balance, the payoff with…

BY QUINN GORMLEY AND TODD FENTRESS A new Opportunity Zone program to encourage investment in low-income community business was included in the 2017 Tax Cuts and Jobs Act. New rules in the code[1] allows taxpayers to defer capital gains on the sale of stock, business assets, or any property (whether or not the asset sold was located or related to…

Being homeless was never part of John’s life plan. But in a world where 58,000 veterans are homeless and an additional 1.4 million veterans are at risk of homelessness, his experience with affordable housing is not unique. Tidwell Group wanted to better understand the situation that so many people like John find themselves in, so they sat down with the…

There is a stark upward trend in the aging of affordable housing properties and it does not appear to be tapering anytime soon. In fact, aging housing inventory is on the rise and has continued to increase year-over-year with a peak expected in the year 2024. This trend provides opportunities for affordable housing developers. Tidwell Group shares insight on how…

On November 2nd, the Tax Cuts and Jobs Act introduced in the House of Representatives proposes the elimination of the Bond Program and the effective elimination of the 4% Housing Credit. We cannot overstate the vital role these programs play in building and preserving affordable housing throughout the nation. While the proposed House Tax Reform Bill appears to retain the much…

Hurricanes Maria, Harvey, and Irma took lives and pummeled the economies of the affected areas. The impact of these natural disasters could extend to Low Income Housing Credit (LIHTC) projects if the proper measures are not taken within a specified time to ensure that projects meet development benchmarks or if affordable housing properties that are damaged by natural disasters are…

Are you aware of the potential tax refunds, accelerated tax deductions and low equity requirements that HUD-insured projects may provide developers? If not, you may be missing out on an aspect of the real estate industry that can provide significant rewards. According to Josh Northcutt, a partner with Tidwell Group, (more…)

You may be eligible for hundreds of thousands in tax credits. In addition to low-income and historic tax credits, many developers are finding out the Section 45L (energy efficiency) tax credits can save hundreds of thousands, even millions, on new residential and mixed-use projects. Case Study: A client recently completed an apartment complex renovation project made up of 330 units.…

Several Accounting Standards Updates (“ASU” or “ASU’s”) issued by the Financial Accounting Standards Board (“FASB”) became effective January 1, 2016. Many of these updates, which are now part of the Codification, will have a direct impact on the accounting and financial reporting of private real estate companies in 2016; whereas, a lot of them will not. The following is a…